Crypto Tax Calculator 2024 - 2025

Use Blockstats to calculate your crypto tax liability across federal and state levels fast, accurate, and free.

Estimate your crypto tax for the period 1/1/2023 - 31/12/2023

Your pre-tax gain is:

$4,900.00

Profit/Loss Summary

Capital Gains Breakdown

$4,900.00

Short-Term Capital Gains (STCG)

0.0%

$0.00

Long-Term Capital Gains (LTCG)

100.0%

$4,900.00

Total Profit/Loss

$4,900.00

Total Tax Liability

$735.00

Net Gain After Tax

$4,165.00

Disclaimer: This information is intended only as a general estimate for U.S. capital gains taxes and assumes all amounts are in USD. It does not account for prior year loss carryovers, deductions, tax credits, or capital losses that may reduce your gains. Please consult a qualified tax professional for personalized advice.

FAQ

Get answers to the most frequently asked questions

How to calculate crypto taxes with our tax calculator?

- Select the year you’re filing for

- Choose whether it’s a single trade or multiple trades

- Fill in your figures

- Pick your state and filing status

- Switch short/long-term toggle on or off

- Check your estimated tax bill

How do we estimate your capital gains taxes?

We calculate capital gains by finding the difference between your purchase and selling price, then apply the right tax rate.

What if I don't have the information I need?

You can use estimates for a rough idea, but for accuracy, you’ll need real transaction data.

How Blockstats calculates crypto taxes?

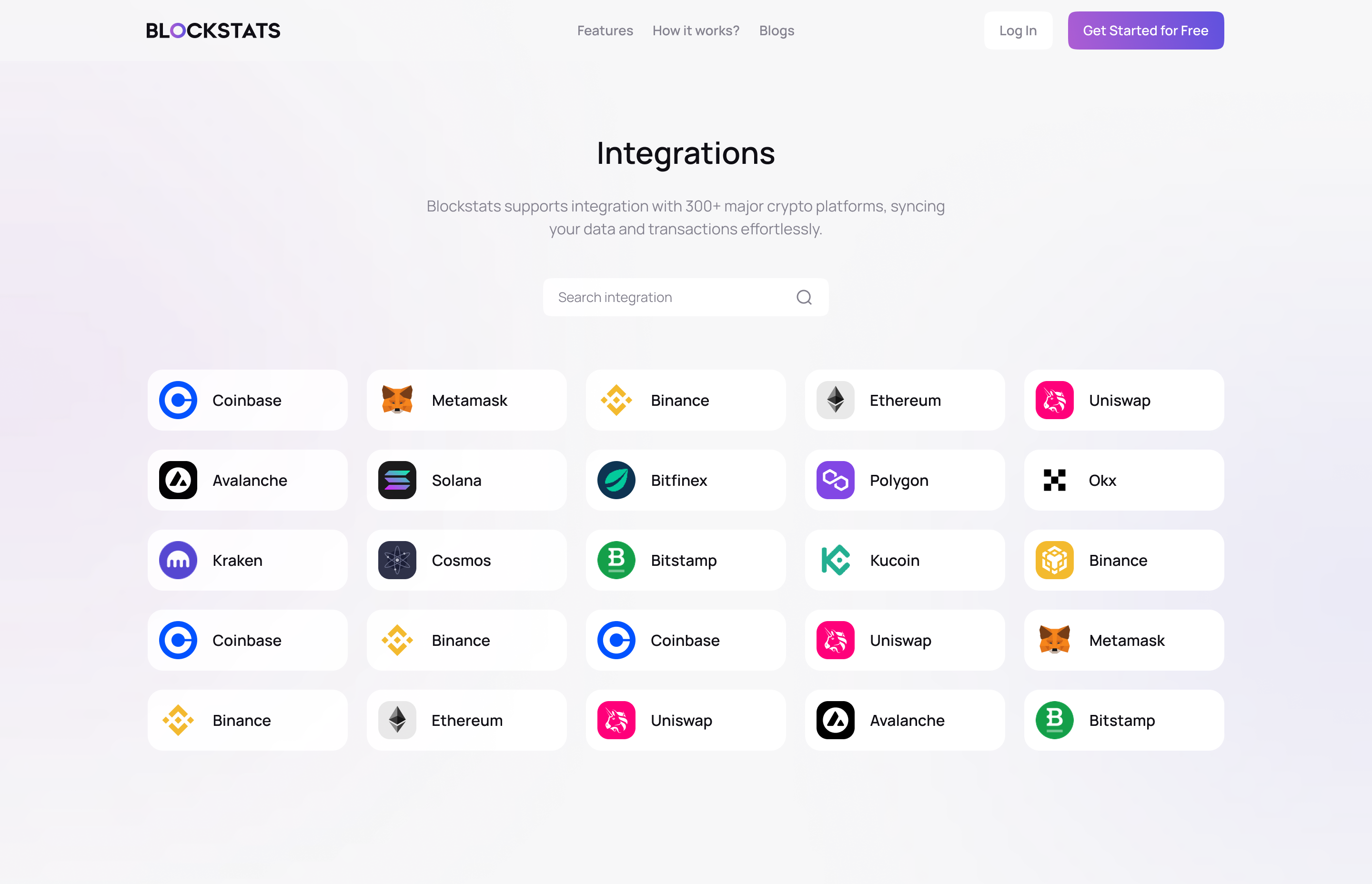

1. Connect accounts

Connect 900+ exchanges, wallets, or blockchains via API, CSV, or public address.

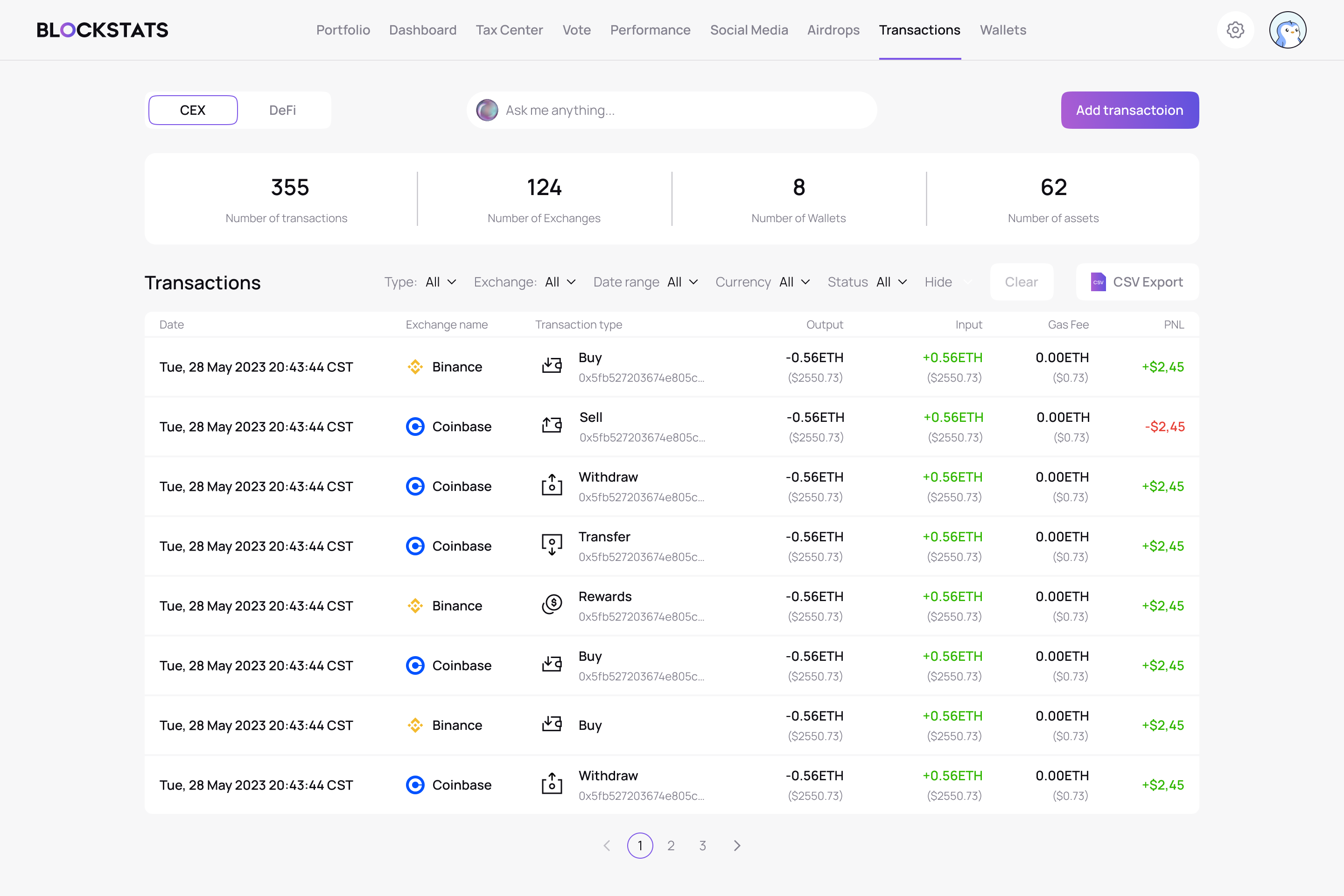

2. Review transactions

Automatic checks and guidance help ensure accuracy.

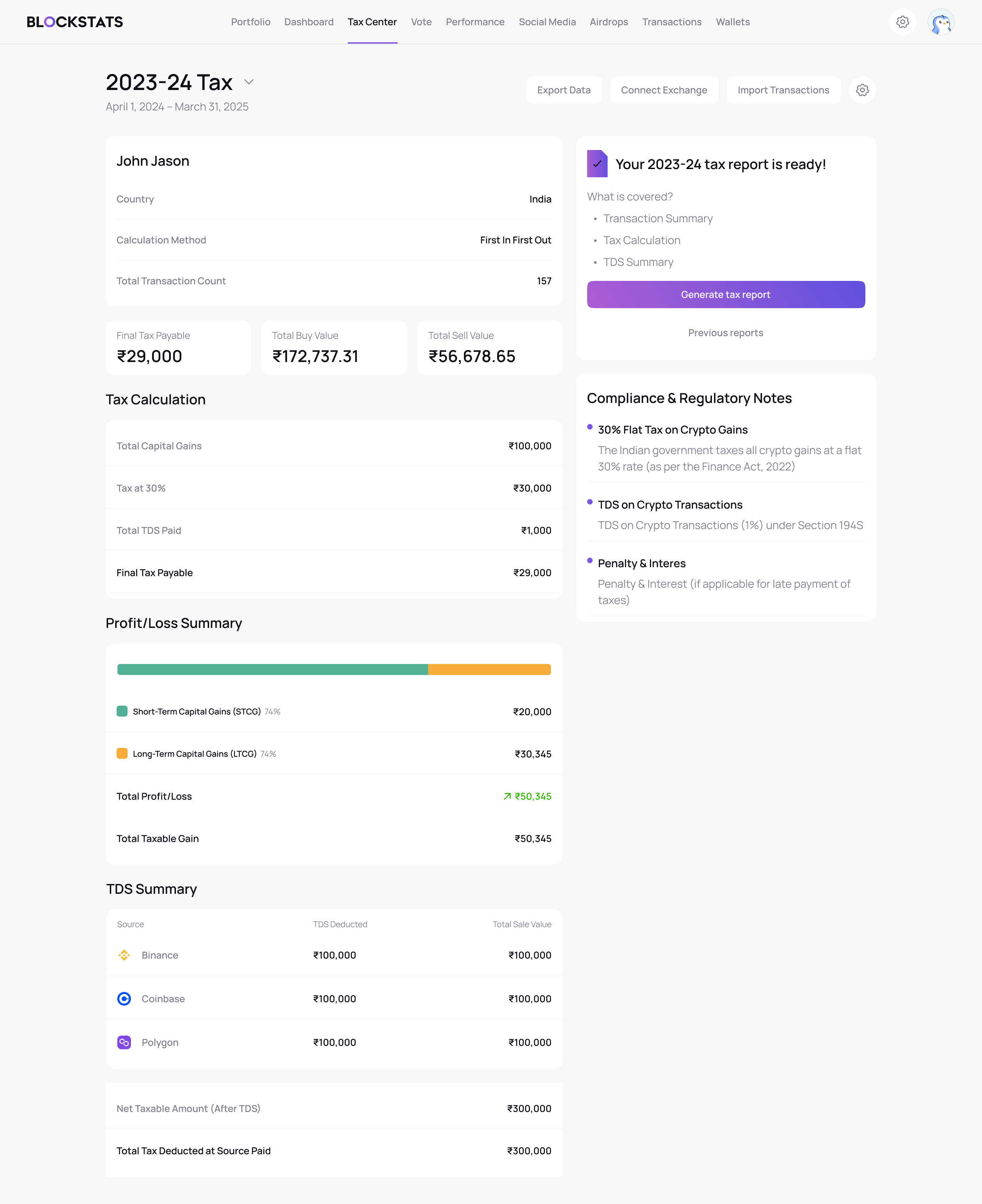

3. Generate tax report

Download IRS Form 8949, Schedule D, TurboTax exports, and more.

Tax Report

Choose CSV or PDF format to download