Crypto Profit Calculator

Easily calculate your cryptocurrency profit or loss for your trades and tax returns

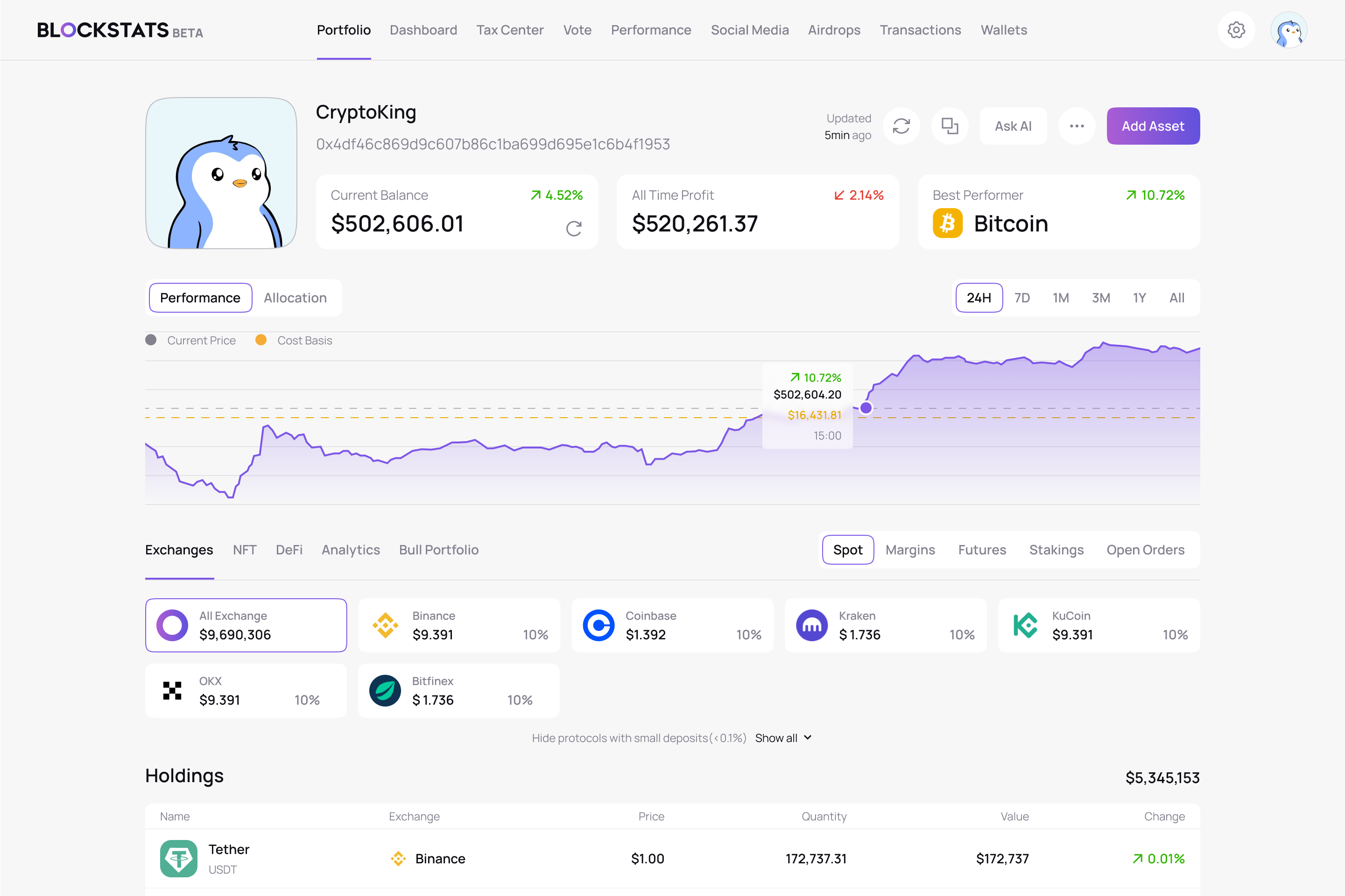

Profit

FAQ

Get answers to the most frequently asked questions

How to calculate crypto taxes with our tax calculator?

- Select the year you’re filing for

- Choose single or multiple trades

- Fill in your figures

- Pick your state and filing status

- Toggle short/long-term gains

- Check your estimated tax bill

How do we estimate your capital gains taxes?

We calculate gains by subtracting your purchase from your selling price, then applying the right tax rate based on holding period.

What if I don’t have the information I need?

You can use estimated values for a rough idea, but for accuracy, real transaction data is needed.

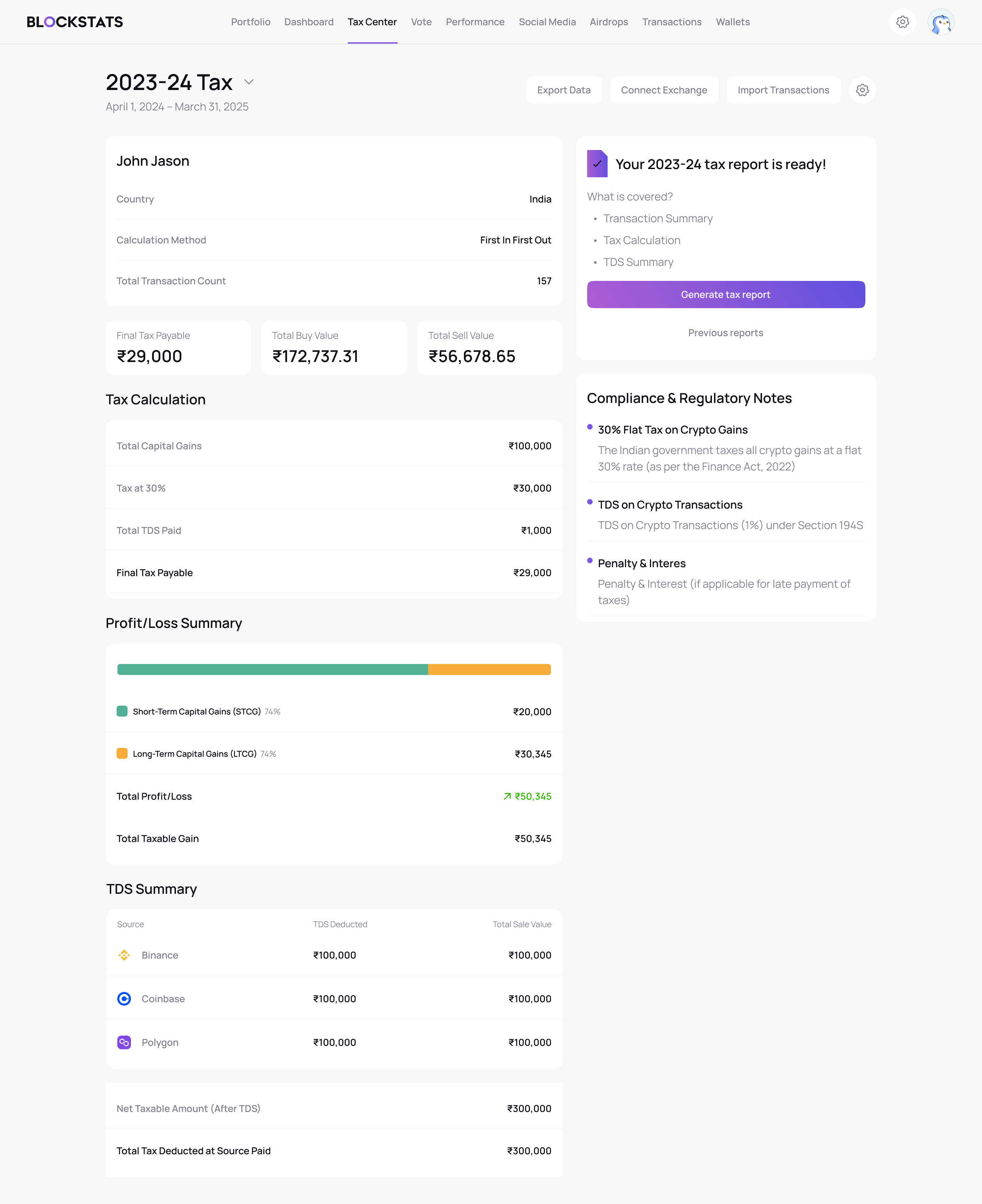

How Blockstats calculates crypto taxes?

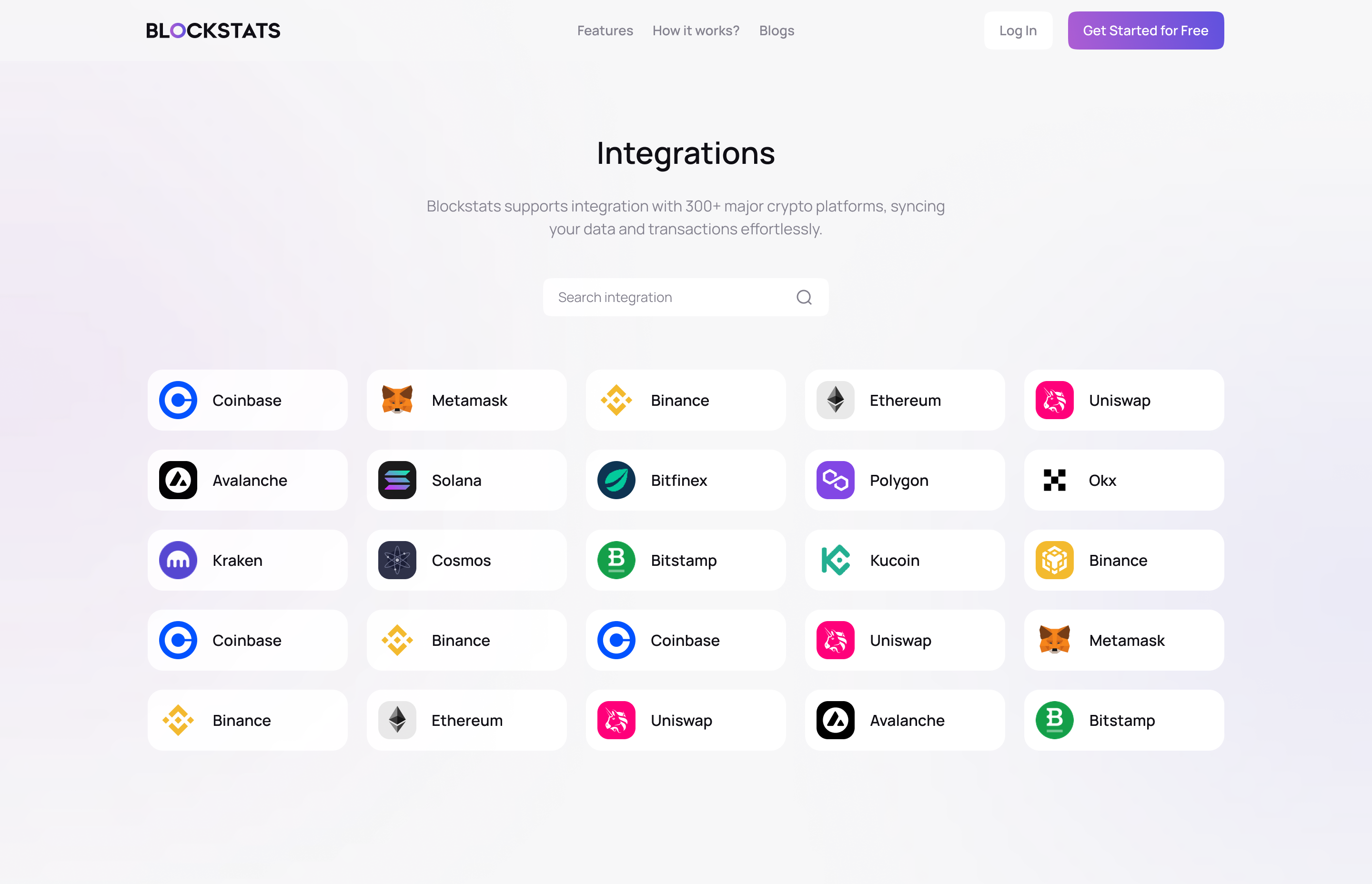

1. Connect accounts

With support for 900+ exchanges, wallets, and blockchains, importing your data is simple: just connect via public address, API key, or upload a CSV — and we’ll do the rest automatically.

2. Review transactions

Ensure your data is accurate with automatic checks and step-by-step guidance.

3. Generate tax report

Download IRS Form 8949, Schedule D, TurboTax exports, and more.

Tax Report

Choose CSV or PDF format to download

What Our Users Say

Real feedback, real success

"Found $1,200 in savings"

David Rodriguez, Portfolio Manager, Texas

Switched from Koinly and immediately found $1,200 in missed loss harvesting opportunities. This tool pays for itself.

"Saved me 45 hours of work"

Sarah Chen, Yield Farmer, New York

Finally, a crypto tax tool that actually works with DeFi. Tracked my Uniswap LP tokens perfectly. Never going back to spreadsheets.

"Saved me $680 in fees this tax season"

Mike Johnson, DeFi Trader, California

Saved me $680 vs what I paid last year for tax prep. The AI caught deductions my accountant missed. Setup took literally 5 minutes.