Bear Market vs. Bull Market in Cryptocurrency

If you have spent any time in crypto, you have likely heard the terms "bear market" and "bull market." These two phrases describe the overall direction of the market, and understanding them is essential for every trader and investor.

In this guide, we will explain the key differences between bear and bull markets, how they impact prices and sentiment, and how you can adapt your strategy during each phase.

What Is a Bull Market?

A bull market in cryptocurrency refers to a period of rising prices, optimism, and strong investor confidence. It is the time when assets like Bitcoin, Ethereum, and altcoins surge in value, attracting media attention and a wave of new retail investors.

Characteristics of a Bull Market:

-

Prices of major coins steadily increase over weeks or months

-

Positive news and hype drive further investment

-

Retail and institutional money flows in

-

New technologies (like NFTs, DeFi, AI tokens) often emerge and dominate

-

Fear of missing out (FOMO) leads to higher volatility

Example: In late 2020 through 2021, the market saw a historic bull run, with Bitcoin reaching over $60,000 and altcoins like Solana, Cardano, and Avalanche reaching all-time highs.

What Is a Bear Market?

A bear market, by contrast, is a prolonged period where crypto prices decline or stagnate, usually by more than 20% from recent highs. During bear markets, investor sentiment turns negative, and many projects face reduced activity and funding.

Characteristics of a Bear Market:

-

Prices fall sharply and remain low for extended periods

-

Fear and uncertainty dominate sentiment (FUD)

-

Lower trading volume and reduced interest from new investors

-

Projects struggle to maintain momentum and community engagement

-

Focus shifts from speculation to building and survival

Example: The 2022–2023 crypto bear market saw Bitcoin drop below $20,000, with many altcoins losing over 80% of their value from their peaks.

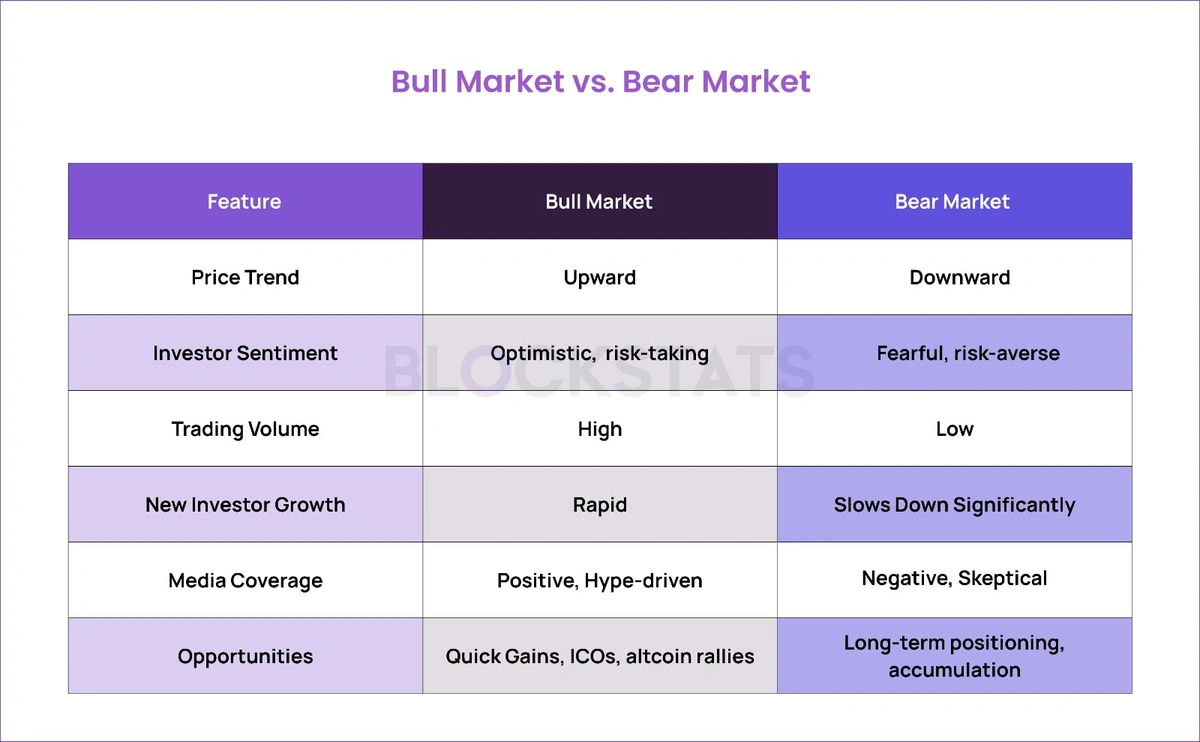

Key Differences: Bull Market vs. Bear Market

How to Invest Differently in Each Market?

In a Bull Market:

-

Ride momentum with trending tokens and narratives

-

Take partial profits regularly to lock in gains

-

Watch for overheated sectors and avoid buying tops

-

Be cautious of rug pulls and scam projects that flourish during hype

In a Bear Market:

-

Focus on accumulating quality assets at lower prices

-

Take time to research and learn, as noise levels drop

-

Consider staking or yield strategies to earn passive income

-

Prepare for the next cycle with a well-defined strategy

Tools like Blockstats can help you track portfolio performance, monitor key on-chain metrics, and stay updated with sentiment shifts across both market types.

Emotional Psychology of Market Cycles

Investor psychology plays a huge role in both bull and bear markets.

-

Bull markets encourage overconfidence. Many believe prices will go up forever, often leading to poor exit timing.

-

Bear markets induce fear and doubt. Even great projects are undervalued, and investors may sell at a loss out of panic.

Recognizing these emotional traps is key to becoming a successful long-term crypto investor.

Stay ahead in bull and bear markets with Blockstats

Bull and bear markets are two sides of the same crypto coin. While the bull run is thrilling and filled with opportunity, the bear market offers time for reflection, rebuilding, and strategic positioning.

Understanding how to navigate both environments is important for growing and protecting your crypto investments.

With the help of platforms like Blockstats, you can analyze market cycles, optimize your trades, and make smarter decisions—whether you are buying the dip or chasing new highs.