Free Crypto Tax Calculator 2025

Use our free crypto tax calculator to quickly estimate your capital gains tax with federal and state tax bills for both short and long-term gains in 2025.

Your pre-tax gain is:

$4,900.00

Profit/Loss Summary

Capital Gains Breakdown

$4,900.00

$4,900.00

Total Profit/Loss

$4,900.00

Federal Tax

15.0% tax rate

$735.00

State Tax (Alabama)

5.00% tax rate

$245.00

Total Tax Liability

$980.00

Net Gain After Tax

$3,920.00

Disclaimer: This information is intended only as a general estimate for U.S. capital gains taxes and assumes all amounts are in USD. It does not account for prior year loss carryovers, deductions, tax credits, or capital losses that may reduce your gains. Please consult a qualified tax professional for personalized advice.

Calculate taxes across your entire portfolio

Connect your exchange and wallets to the Blockstats crypto tax calculator USA

Start for freeHow to use crypto tax calculator?

Using our crypto tax calculator is straightforward. Here's how it works:

- Fill in your figures like your purchase price, selling price, and any fees.

- Pick your state and filing status to ensure accurate tax rate calculations.

- Enter your total income.

- Toggle between short or long-term gains based on how long you held your crypto.

- Check your tax amount instantly.

Blockstats calculates estimated taxes based on the information you provide to identify your state and federal tax rate. If your gains span multiple tax brackets, they’re applied proportionally to ensure accurate estimates.

How do I calculate my purchase price of cryptocurrency?

Your purchase price, also called cost basis, includes what you paid for the crypto plus any allowable transaction fees. When you acquire the same asset multiple times, the IRS requires consistent cost-basis tracking. Blockstats automatically handles this across wallets and exchanges.

What is the tax rate on cryptocurrency in the USA?

This depends on how long you've held your investment, your total annual income, and the transaction you've made. Crypto income and short-term gains may be taxed at up to 37%, plus any state taxes. Meanwhile, long-term gains from selling, trading, and spending crypto are taxed between 0% - 20% depending on your income. Long-term gains from NFTs deemed collectibles may be taxed at up to 28%.

Why do I need to enter my location?

While federal tax rates apply nationwide, state tax rates vary. Entering your location allows the tax calculator to identify the state tax rates where you reside to give you a more accurate estimate of your tax liability. Some states have no income tax, while others can add substantial amounts to your overall tax bill.

Why is my annual income important?

Your annual income determines which federal and state tax brackets apply to you. This directly impacts both short-term capital gains and crypto income tax rates. Blockstats uses this information to calculate accurate estimates across multiple brackets if needed.

Why is my length of ownership important?

How long you owned your crypto before disposing of it directly impacts the amount of tax you'll pay. Short-term gains from assets held less than a year are taxed at your Income Tax rate, while long-term gains are taxed at a substantially lower long-term Capital Gains Tax rate. This difference can be significant, potentially saving you thousands of dollars.

Why my filing status required?

Your filing status determines your filing requirements, standard deduction, eligibility for certain credits, and your correct tax. There are four different filing statuses such as single, married filing jointly, married filing separately and head of household. Each status has different tax brackets and rates, which directly affect your final tax bill.

Connect your wallets and get your complete crypto tax report

Signup nowWhat is a crypto tax calculator?

A crypto tax calculator is a tool designed to help cryptocurrency investors estimate their tax liability quickly and accurately. Instead of manually calculating your gains, losses, and applicable tax rates across federal and state levels, a crypto tax calculator does the heavy lifting for you.

Blockstats tax calculator uses your transaction data like purchase price, selling price, holding period, and location to determine which tax rates apply to your specific situation. The result is an estimated tax bill that helps you plan ahead and avoid surprises when tax season arrives.

How is cryptocurrency taxed?

In the United States, cryptocurrency is taxed as property. This means most crypto transactions fall under capital gains tax or income tax, depending on the activity. You pay up to 37% on cryptocurrency income and short-term gains, and up to 20% in Capital gains tax on long-term gains, and applicable state taxes.

What are capital gains?

Capital gains occur when you dispose of cryptocurrency for more than its purchase price. A disposal includes selling crypto, swapping one token for another, or using crypto to pay for goods or services. If the value increases, you have a taxable gain. If it decreases, you realize a capital loss, which may be deductible.

How do I calculate my capital gains on cryptocurrency?

Calculating capital gains on cryptocurrency requires you to know three key figures: your purchase price, that is the cost basis, your selling price, and any associated fees.

The formula is simple:

Capital Gain = Selling Price - Purchase Price - Fees.

For example: If you bought Bitcoin for $30,000, paid $50 in fees, then sold it for $45,000 with another $50 in fees, your capital gain would be $14,900. That's $45,000 - $30,000 Minus $100 in total fees. This gain is then taxed based on how long you held the asset and your total income.

How to calculate short-term capital gains tax?

Short-term capital gains apply when crypto is held for less than one year before disposal. These gains are taxed at your ordinary income tax rate, based on your total annual income and filing status. These rates can range from 10% to 37% at the federal level, depending on your income bracket. Blockstats applies your federal and state income tax rates to short-term gains for accurate estimates.

How to calculate long-term capital gains tax?

Long-term capital gains apply to crypto held for more than one year. These gains are taxed at lower federal rates,typically 0%, 15%, or 20%, depending on your income. State taxes may still apply unless you live in a state with no income tax.

Do fees reduce my tax bill?

Yes! Purchase and sale fees are deductible. This means they can be factored in as allowable expenses when calculating your cost basis, so you can use fees to reduce your tax liability. Every fee you pay when buying or selling crypto decreases your taxable gain, putting more money back in your pocket.

How do I reduce my crypto tax?

Most investors opt for two simple strategies: hold assets and utilize losses.

Crypto held for more than a year benefits from a lower, long-term capital gains tax rate than short-term disposals from assets held less than a year. Blockstats helps you track how long you've held cryptocurrencies with AI-powered automation, so you can strategize which assets to dispose of and when for the best tax outcome.

As for losses, while they're bad news most of the time, they're actually great news for your tax bill. You can offset losses against gains to reduce your overall tax bill, and the IRS also allows investors to offset up to $3,000 in losses against ordinary income each year. Blockstats helps you identify unrealized losses and simulate the impact realizing them would have on your tax liability.

You can use our free crypto profit calculator to check your profit and losses on your investments

What is the best crypto tax calculator?

Accuracy is the most important feature of any tax tool. Blockstats stands out by combining high-speed AI automation with rigorous IRS-compliant reporting standards. It’s designed to handle the "heavy lifting" from calculating complex short-term brackets to managing state-specific variations, giving you a finalized tax report you can trust.

FAQ

Get answers to the most frequently asked questions about USA cryptocurrency tax calculator

How do I avoid crypto taxes?

You can't avoid crypto taxes legally, but you can reduce them by holding assets long-term, harvesting tax losses, and timing disposals strategically to lower your bracket.

Why do I need a crypto tax calculator?

A crypto tax calculator saves time and ensures accuracy by automatically applying complex tax rules, tracking cost basis, and calculating gains across multiple transactions and tax brackets.

What is the best Bitcoin tax calculator?

Blockstats offers AI-powered automation to calculate Bitcoin taxes across your entire portfolio. Connect exchanges and wallets for automated, accurate tax reporting without manual data entry.

How much tax do I need to pay on crypto?

Tax depends on your income, holding period, and state. Short-term gains face up to 37% federal tax, while long-term gains range from 0-20%, plus state taxes.

How do I calculate my crypto taxes?

Calculate crypto taxes by determining your cost basis, selling price, and holding period. Apply appropriate tax rates based on your income and filing status for accurate liability.

Are there state taxes on capital gains?

Yes. Most states tax capital gains as ordinary income, though rates vary by state. Some states like Texas and Florida have no state income tax on gains.

How is cryptocurrency taxed in the United States?

Cryptocurrency is taxed as property in the US. Short-term gains are taxed as ordinary income up to 37%, while long-term gains are taxed between 0-20% based on income.

What are taxable events in cryptocurrency?

Taxable events include selling crypto for fiat, trading one crypto for another, spending crypto on goods or services, and earning crypto as income or rewards.

How Blockstats calculates crypto taxes?

1. Connect accounts

Connect 900+ exchanges, wallets, or blockchains via API, CSV, or public address.

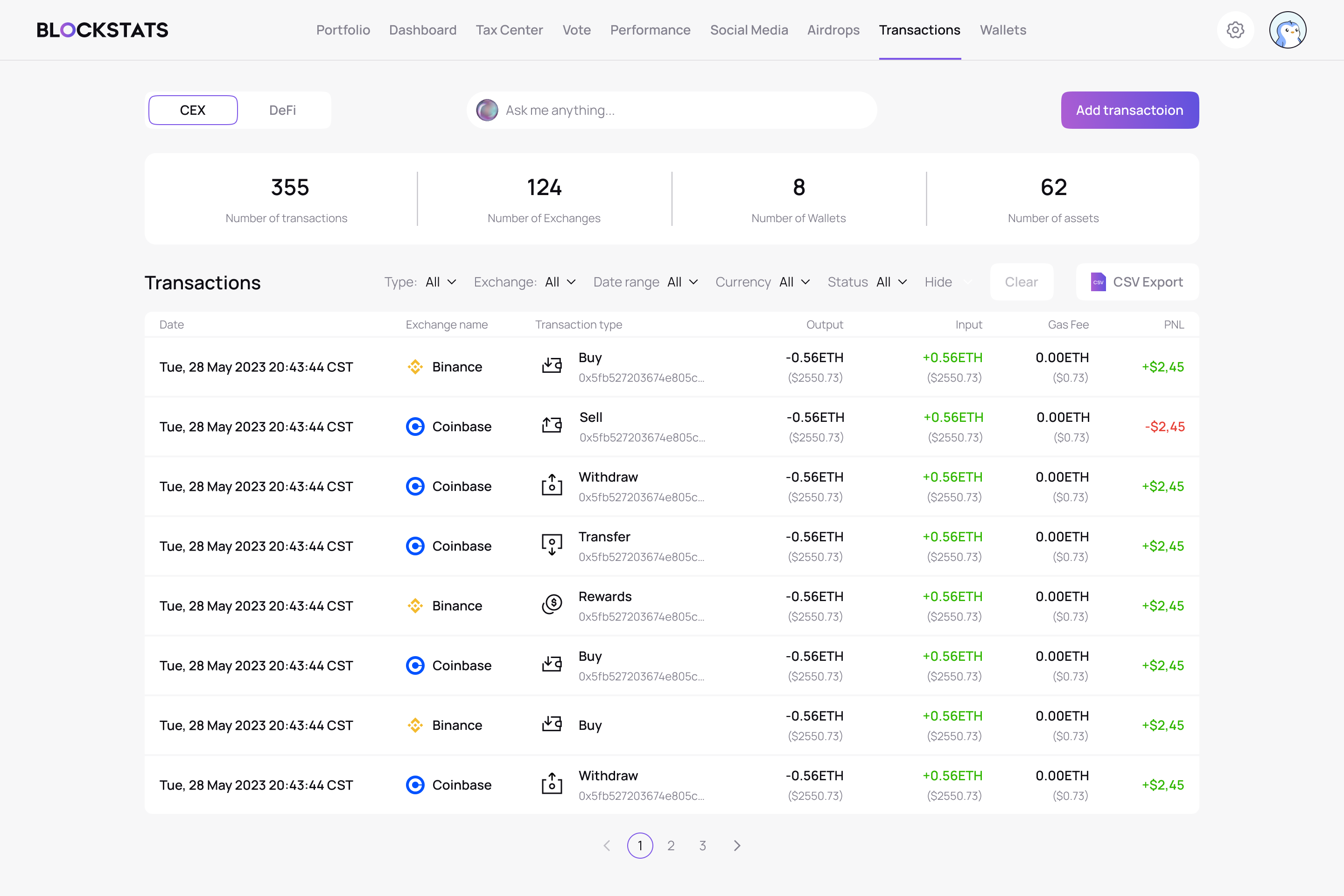

2. Review transactions

Automatic checks and guidance help ensure accuracy.

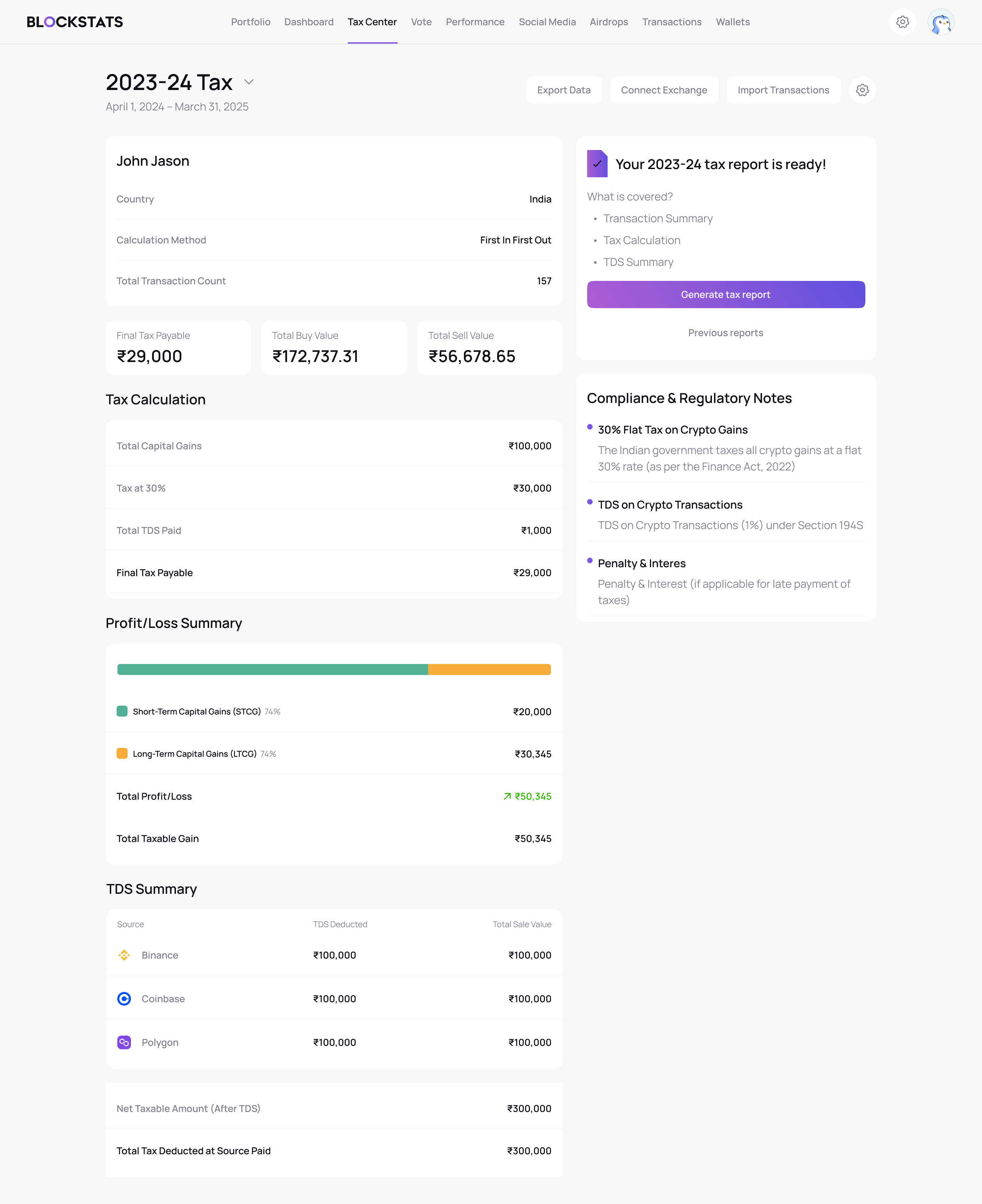

3. Generate tax report

Download IRS Form 8949, Schedule D, TurboTax exports, and more.

Tax Report

Choose CSV or PDF format to download