How to Report Your Kraken Taxes

Tax season is approaching, and you want to calculate your Kraken taxes, including your gains, losses, and income. All you have to do is connect Kraken to Blockstats.

Quick summary:

|

Exchange/Platform |

Kraken |

|

Supported Method |

API Keys |

|

Estimated time |

5-10 min |

|

Get Started |

This detailed guide covers how to manage your Kraken taxes, covering everything you need to smoothly integrate your data with Blockstats for precise capital gains and income reporting.

How to connect Kraken and Blockstats: Step-by-Step Guide

Follow the step-by-step guide to sync your Kraken data automatically with API keys:

Using the API connection is the most efficient and error-free method to sync real-time transaction history from Kraken into Blockstats.

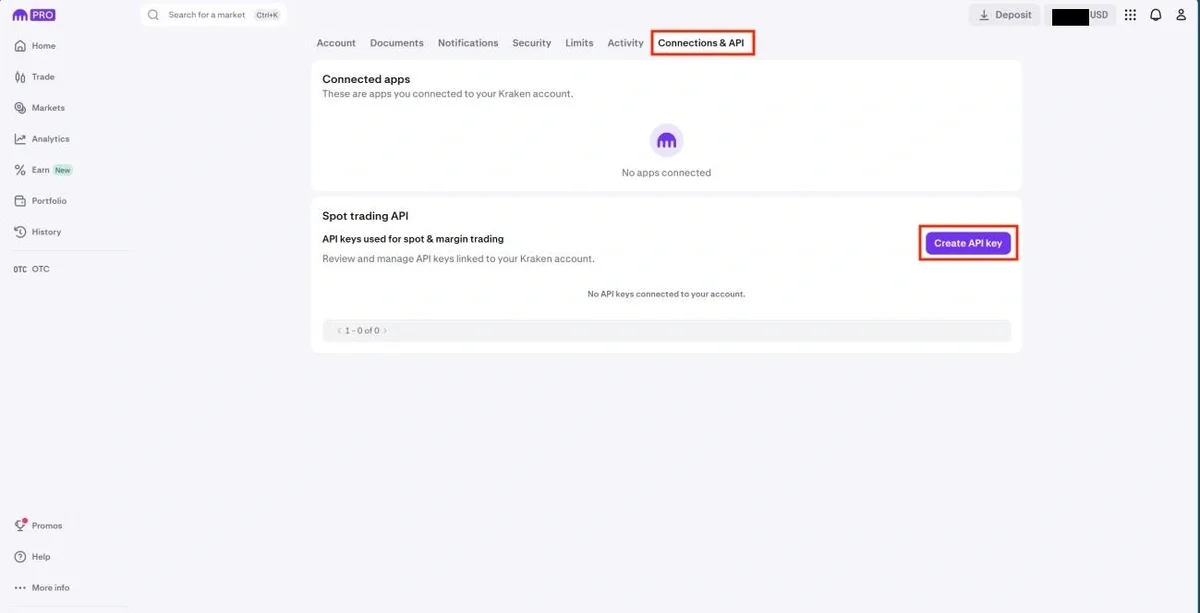

On Kraken: Generate API key

Step 1: Log in to your Kraken account.

Step 2: Go to your Profile in the top right corner, and select Security.

Step 3: Select the Connections & API, and then click on Create API key.

Step 5: On the add API key page, enter a name into the key description box, for example, “Blockstats”. Check the boxes: Query, Query closed orders & trades, Query ledger entries, and Export data. Once done, select Generate Key button.

Step 6: Once generated, copy and save the API key and API Secret in a secure location, as it provide access to your account data.

On Blockstats: Connect Kraken to Blockstats

Step 1: Log in or sign up for Blockstats

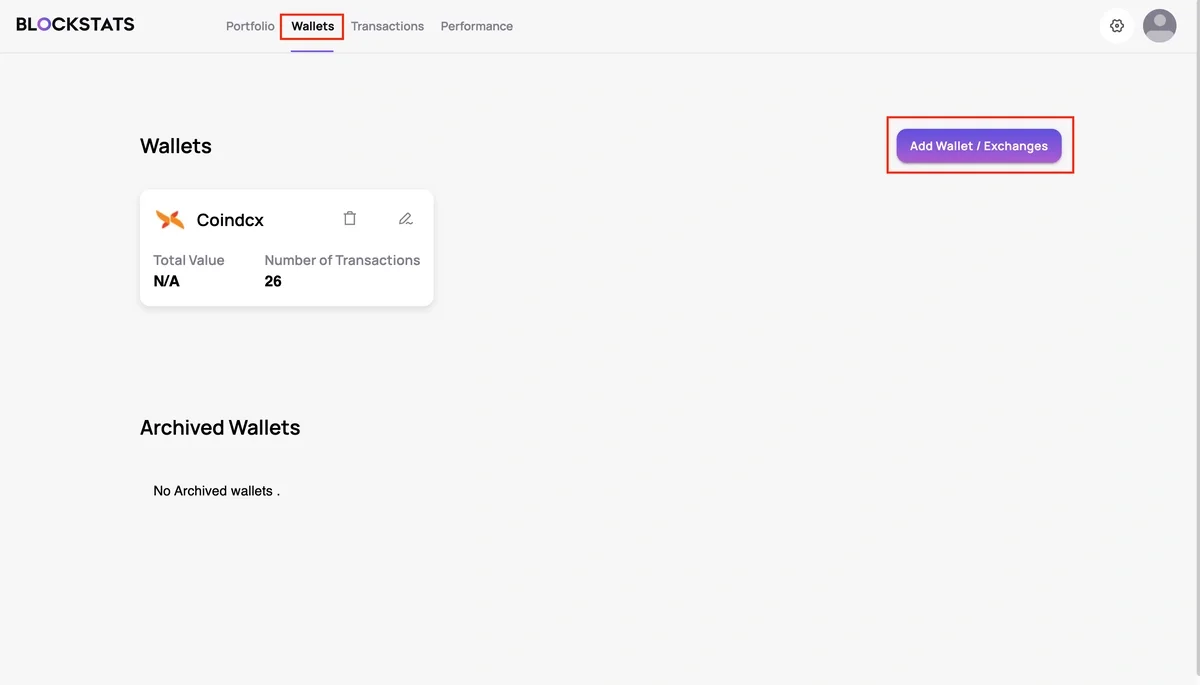

Step 2: Go to the Wallets Page and then Add Wallet / Exchanges

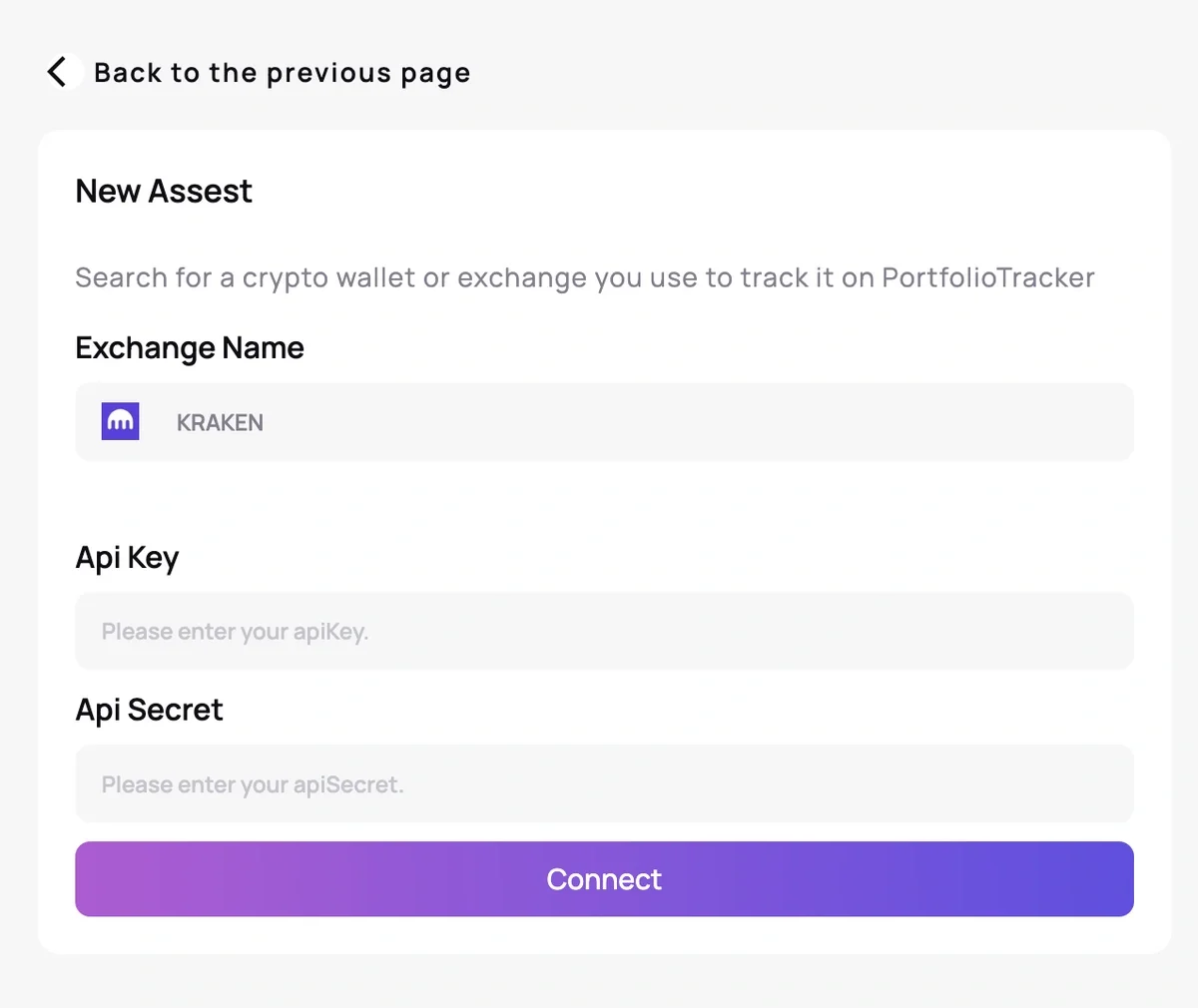

Step 3: Search for and select the Kraken exchange.

Step 4: Input the API Key & API Secret and click on the Connect button to link your Kraken account with Blockstats

How are Kraken transactions taxed?

Crypto transactions taxes depend on the country or the region you live in. Crypto transactions fall into two main categories for taxation: Capital Gains Tax and Income Tax.

Crypto tax differs based on your location. However, generally, your Kraken investments may be subject to two types of taxes:

-

Capital Gains Tax: This tax may apply when you profit from disposing of crypto through selling, swapping, spending, or, in some cases, gifting. It also generally applies to realized profits from margin and futures investments.

-

Income Tax: This tax may apply when you acquire new coins, such as staking rewards on Kraken.

Read our guide on how to calculate crypto taxes in the U.S. for detailed information.

Does Kraken report to the IRS?

Yes, Kraken reports user activity to the tax agencies, including the IRS. Tax agencies are cooperating with exchanges to access KYC data and verify reported crypto income.

Also, the IRS has used a John Doe Summons, forcing the exchanges to hand over customer data.

How to do your Kraken taxes?

Every disposal of cryptocurrency is a taxable event. The key to filing accurately is gathering a complete record of your transaction history and calculating the correct cost basis for every asset sold, traded, or spent.

Due to the volume and complexity of crypto transactions, most users find that Blockstats crypto tax software is the most reliable way to calculate their final tax liability.

Ready to simplify your tax calculation? Start calculating your Kraken taxes for free with Blockstats today!

Need help?

Having trouble connecting your Kraken account to Blockstats?

-

Visit our Help Centre

-

Reach out to us on Telegram or X (Twitter)

-

Email us at support@blockstats.app

Frequently asked questions

Why aren't my Kraken tax documents accurate?

Kraken's documents may be inaccurate if you transferred crypto into Kraken from outside of Kraken. Or you traded across multiple exchanges, wallets, and DeFi protocols, making tax calculations more complex. That’s why a crypto tax calculator like Blockstats is recommended, which combines data from all your wallets and exchanges accurately.

Do I have to pay taxes on Kraken?

You have tax obligations if you engaged in crypto activities such as selling for a gain, trading, spending, or receiving crypto income like rewards, staking. Failure to comply can result in fines or imprisonment.

Does Kraken automatically deduct taxes?

No, Kraken does not automatically deduct taxes. Countries' tax systems, like, U.S. tax system, require you to track your gains, losses, income and calculate your crypto tax liability. However, crypto users can connect Kraken account to Blockstats and seamlessly generate their crypto tax reports within minutes.

Does Kraken provide tax documents?

Kraken provides a 1099-MISC Form for U.S. investors with more than $600 in income. Others can calculate Kraken tax using transaction history.