How to Calculate Crypto Gains and Losses?

As cryptocurrency investing becomes more mainstream, understanding how to calculate gains and losses is very important, not just for tracking your investment portfolio but also for tax compliance. Whether you are selling Bitcoin, swapping Ethereum, or using crypto to buy goods, each event may have tax implications. At Blockstats, we will walk you through how to accurately calculate your crypto gains and losses.

Expert Advice: Do not wait until the financial year ends to get organized. Start tracking your crypto transactions today, calculate your gains and losses in real-time, and make informed investment decisions backed by data.

What Are Crypto Gains and Losses?

A crypto gain refers to when you earn money from selling or exchanging cryptocurrency for something more than its purchase price. A crypto loss occurs when you sell or exchange it for less than its price. In the majority of countries, you will need to declare these gains or losses when tax time comes around.

Example Calculation:

- Formula: Capital Gain or Loss = Selling Price - Cost Basis

- Selling Price: The value of the crypto at the time you sold or traded it.

- Cost Basis: The original amount you paid to acquire the crypto, including fees.

Scenario 1: You bought 1 ETH for $1,500 and later sold it for $2,000.

Cost Basis: $1,500

Selling Price: $2,000

Capital Gain: $2,000 - $1,500 = $500 Gain

Now let’s flip it.

Scenario 2: You bought 1 ETH for $2,000 and sold it at $1,200.

Capital Loss: $1,200 - $2,000 = $800 Loss

FIFO vs. LIFO vs. Specific Identification

Tax rules may vary depending on your location, but these are the most common accounting methods:

- FIFO (First-In, First-Out): You sell the oldest crypto first.

- LIFO (Last-In, First-Out): You sell the most recently acquired crypto first.

- Specific Identification: You choose which specific crypto unit you are selling (requires detailed record-keeping).

Tip: Most countries default to FIFO unless otherwise stated.

Types of crypto transactions to calculate gains/losses

-

Selling for fiat currency

-

Trading one crypto for another

-

Using crypto to buy goods or services

-

Converting crypto to stablecoins (e.g., USDT, USDC)

Note: Transferring crypto between wallets you own is a non-taxable event and does not involve gains or losses.

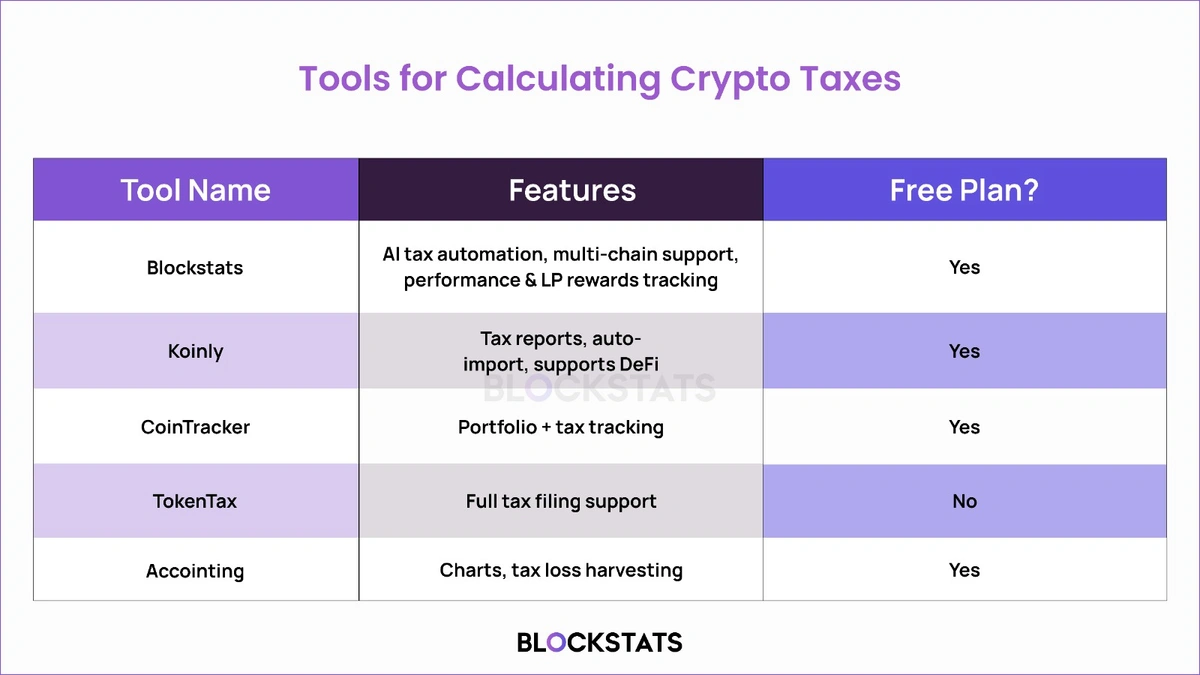

Best tools for calculating crypto taxes

Manually calculating gains across multiple transactions can be difficult. Here are tools that automate it:

What if you have losses?

In many countries, if you lose money on one investment, you can use that loss to reduce the taxes on profits from other investments. If your losses exceed gains, you may be able to carry them forward to future tax years (check local rules). Some countries allow using up to a certain amount of losses to reduce taxable income annually.

Still Calculating Manually? Your Portfolio Deserves Better

Accurate calculation of crypto gains and losses is necessary for reporting and compliance, as well as financial planning. By maintaining detailed records, understanding the tax implications, and using reliable crypto portfolio trackers like Blockstats, the entire process is easier. From automatically connecting your wallets and exchanges to calculating realized gains and losses, Blockstats simplifies the complexities of crypto taxation and reporting.

Ready to simplify your crypto portfolio management?

Sign up for Blockstats and experience seamless tracking, powerful analytics, and effortless crypto tax reporting.